CTC : Everything You Need To Know About Cost To Company

Business organizations are obliged to pay their employees a certain sum of money in return for the services provided by the employees. This money, called salary, can be described by employers as the cost of acquiring, retaining, and operating human resources. The wage of employees may be viewed from the point of view of the employer and employee relationship as the money and/or benefits earned to meet personal costs. The word ‘CTC’ poses a major question for employees, and, thus, they must understand better what CTC means. It saves needless email problems with the payroll team. It also saves money. In this article, we will learn about the CTC and salary breakup in depth. So let’s read and find out.

In the same region, salaries are normally of particular significance for all employees performing similar work in similar industries. They shall be subject to market pay rates and the minimum allowable wages by operational laws and regulations. However, specific skills, abilities and certifications must be understood to be factors that could lead to different salary structures.

Wages consist of basic salaries, housing allowances, dearth allowances, and others, which every employee must know about. While certain allowances are taxable, others are exempt in whole or in part. New entrants in the corporate world may at first be fascinated by astronomical wages. But, if they have a lower salary than their expected estimates, they are often disappointed. What’s that difference, then? It must be understood that your appointment letters do not mention the take-home salary. Let’s talk about some of the breakdowns of your wage structures to distinguish the difference between similar, sounding wage terms.

What is CTC?

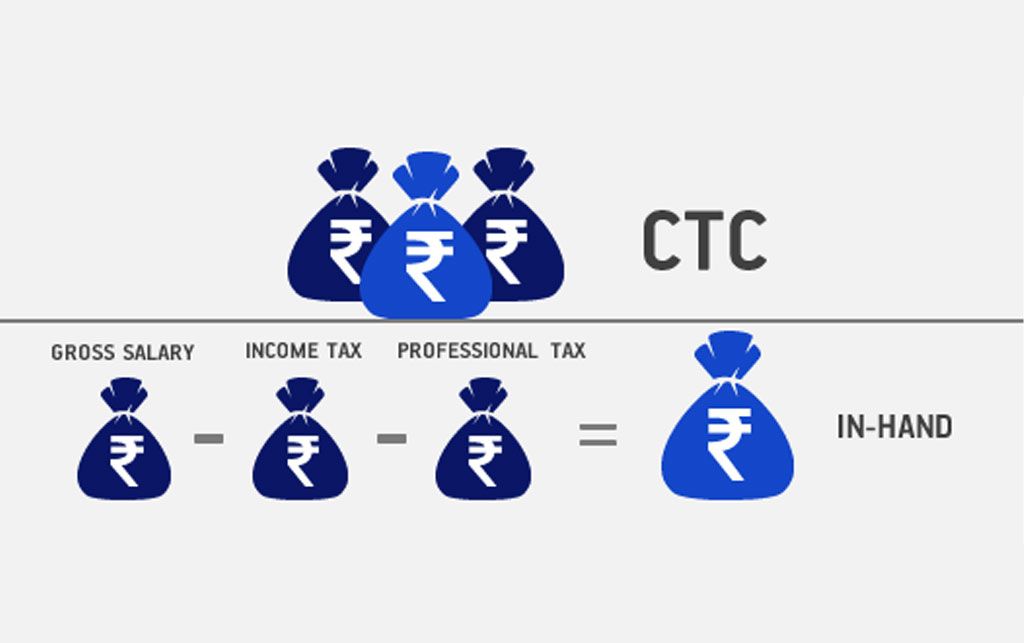

Cost to Company or CTC is the salary package that an employee is offered. The fact that CTC shows the total amount of expense an organization incurred in an employee during the year, including all the facilities that an employee has acquired during the service period. This information is left unread by most employees during their first job.

In other words, the CTC does not represent the actual employee salary but the sum of all the costs associated with a contract of employment. It means the cost of the company as an employee to you. Surprisingly, most CTCs include mandatory deductibles such as those for the provident fund, health insurance, and so on. It must be noted that your company’s salary and other searches mean a certain cost to your company and hence the term. They are thus part of your compensation structure, but as a part of your salary, you do not receive them. Benefits will increase your CTC but will not increase your net salary.

What is a basic salary?

Basic salary is the individual’s base income. The amount paid to the employee before any increase or reduction due to bonus or overtime or any allowances (included internet usage for employees who work from home). According to industry experts, the basic salary varies depending on the type of industry. For example, IT industry workers prefer home pay (since their employee turnover is high), whereas manufacturing firms’ employees receive more limited benefits.

What do you mean by salary?

The word “salary” is derived from the Latin word “salarium.” In addition to their salaries, it was the salt quota that Roman soldiers were granted. The received money is termed as salarium or salt money, which was later termed as ‘Salary’ in modern English. Although, in many instances, the word ‘salary’ is used interchangeably with the word “wages,” it is not identical in strictly technical terms.

What is a salary breakup?

Salary breakup is referred to as the situation where various components which are required for calculating the actual salary is broken. The various components that you must fulfil to determine your salary are:

- CTC or Cost to Company

- Basic Salary

- Bonus

- Allowances

- Provident Fund (PF)

- Tax

- Insurance

- Gross Salary

- Net Salary

Constituents of CTC

Your basic wage, your Dearness Allowance (DA) and your HRA are all subject to your employer’s direct benefits, including a medical allowance, a transportation allowance and a medical allowance and incentives and bonus. These benefits combined with direct advantages, such as interest-free lending, food coupons, company payment of medical and life insurance payments, earnings and leased accommodation and saving contributions, like Superannuation benefits, employer provider fund contribution and free of charge, form your overall CTC. These direct benefits are combined with indirect benefits.

What do you mean by take-home salary?

Take-home salary is the amount of money a person receives following the deduction of employment taxes and benefit costs, and retirement contributions. Your CTC gross salary is deducted from the other benefits, but deductions such as income tax, social security and taxes on Medicare, donations to the fund and so on from your gross salary can be calculated for your net salary. Your take-home salary is usually the net wage unless there are certain personal allowances, such as loan and bond reimbursements, in which case the net salary is even lower.

Difference between CTC and take-home salary

A common reason for the differentiation in the CTC is to add certain parts of your CTC to your long-term savings account, such as the free employer fund and pension allowance but not to your monthly home payment. The other reason for a reduction in your salary is that your employer deducts income tax at source, which is termed as TDS. So, employees should look at what their take-home salary is and not their plump CTCs will be before being deleted by a seemingly lucrative new job offer or when considering a salary appraisal or promotion raise. Employees should also be responsible for determining the amount they will receive in a paid check by calculating their tax liabilities for new income by tax policies.

Final words

So you must be clear about what CTC means and what is the meaning of salary breakup. CTC is a very important element that you must require to calculate the actual salary of the employee. When you join any job, always check the CTC mentioned in the policy to avoid future problems and to know how much you truly earn.

Related Posts: