ATS Tracking Systems UAE 2026 | Applicant Tracking Software

ATS Tracking Systems UAE 2026: Complete Guide to Applicant Tracking Software

- Last Updated: January,05, 2026

- Pricing Verified: January,05, 2026

- Features Checked: January 2026

About The Author

Reviewed by: Shivam Gupta, HR Specialist at Pitch N Hire

- Experience: 10+ years in HR and recruitment management

- Previous Role: HR Specialist, Gigde Global

- Current Position: HR Specialist, Pitch N Hire

- Expertise Focus: ATS platform evaluation, UK recruitment compliance, HR technology implementation

- Contact: shivam.gupta@gigde.com | LinkedIn: Pitch N Hire

About Pitch N Hire

- Founded: 2017

- What We Do: Pitch N Hire is a revolutionary applicant tracking software UK platform designed to streamline and simplify the hiring process for UK organizations. Our platform equips companies with all the essential tools needed to advertise jobs across multiple channels effectively, make data-driven hiring decisions, seamlessly sort and manage applications, design branded mobile-responsive career pages, track recruitment funnels from a single unified dashboard, and attract top talent to build exceptional teams.

- Team Size: 51-200 employees across the UK

- Website: https://pitchnhire.com/

- Key Contact: info@pitchnhire.com | https://pitchnhire.com/contact-us

1.Introduction

In the rapidly evolving UAE hiring landscape, ATS tracking systems UAE have become indispensable tools for organizations seeking to streamline their recruitment processes. An Applicant Tracking System (ATS) is sophisticated recruitment software that automates and optimizes every stage of the hiring workflow—from job posting to candidate onboarding.

As we navigate 2026, the demand for cloud based ATS UAE solutions has surged, driven by the region's commitment to digital transformation and increasingly complex compliance requirements. Whether you're managing a startup in Dubai or leading talent acquisition for an enterprise in Abu Dhabi, understanding modern applicant tracking software UAE is crucial for competitive hiring.

Pitch N Hire has established itself as a trusted authority in recruitment technology UAE, helping organizations across the Emirates transform their hiring operations. This comprehensive guide explores everything you need to know about ATS software UAE, from core functionalities to compliance considerations, with special focus on solutions tailored for the UAE market.

Throughout this article, we'll examine:

- How modern ATS tracking systems work and their business impact

- The unique challenges facing UAE employers in 2026

- Critical evaluation criteria for selecting recruitment software UAE

- Detailed comparisons of top ATS systems UAE

- Implementation best practices specific to the region

- Future trends shaping hiring software UAE

What Is an ATS Tracking System?

An Applicant Tracking System UAE is a centralized software platform designed to manage the entire recruitment lifecycle. At its core, an ATS serves as a digital command center where HR teams can post job openings, collect applications, screen candidates, schedule interviews, and manage communication—all within a single integrated system.

How Modern ATS Works

Contemporary ATS software UAE operates through several interconnected modules:

Candidate Sourcing & Job Distribution: The system automatically posts openings to multiple channels simultaneously, including Bayt ATS integration, GulfTalent integration, Naukrigulf ATS, and LinkedIn Middle East recruiting platforms. This multi-channel approach ensures maximum visibility across the UAE hiring platform ecosystem.

Resume Parsing & Screening: Advanced resume parsing software UAE uses artificial intelligence to extract relevant information from CVs submitted in various formats. The AI recruitment software UAE then scores candidates against predefined criteria, dramatically reducing manual screening time.

Candidate Relationship Management: Modern recruitment CRM UAE functionality enables recruiters to nurture talent pools, maintain ongoing communication with prospects, and build relationships with passive candidates who may be perfect for future openings.

Interview Management: Integrated interview scheduling software UAE eliminates the back-and-forth of coordinating calendars, while automated reminders reduce no-shows and improve the overall candidate experience.

Analytics & Reporting: Comprehensive recruitment funnel analytics provide visibility into metrics like time-to-hire reduction UAE, cost-per-hire UAE, and recruitment efficiency UAE, enabling data-driven decision making.

Benefits for UAE Employers

Organizations implementing best ATS in UAE solutions typically experience:

- Speed: Reduction in time-to-hire by 30-50% through recruitment automation UAE

- Quality: Improved candidate matching through AI applicant tracking system capabilities

- Compliance: Automated tracking of UAE labor law compliant ATS requirements

- Collaboration: Enhanced coordination among hiring teams across multiple Emirates

- Insights: Clear visibility into hiring workflow optimization opportunities

- Experience: Streamlined processes that enhance candidate experience UAE

Top ATS Tracking Systems in UAE 2026

Based on our comprehensive evaluation methodology, here are the leading recruitment software UAE platforms for 2026.

Pitch N Hire — Best Overall ATS for UAE

Overall Score: 94/100

The Platform has earned the distinction of best applicant tracking system UAE 2026 through its exceptional balance of local market understanding and technological sophistication. This AI-powered ATS UAE platform was purpose-built with Emirates hiring requirements at its foundation, not as an afterthought.

Key Strengths:

- Native MOHRE compliant recruitment software with automated reporting

- Comprehensive multi-language ATS (Arabic support) throughout the platform

- Seamless Bayt ATS integration, GulfTalent integration, and Naukrigulf ATS connectivity

- Advanced AI recruitment software UAE with superior resume parsing accuracy

- Dedicated Emiratization analytics and quota tracking

- Flexible pricing suitable for ATS for startups UAE through enterprise ATS UAE

- 24/7 localized support with UAE-based teams

Best For: Organizations of any size seeking a comprehensive hiring software UAE solution with strong compliance capabilities and local support.

Pricing: Custom quotes based on organization size and requirements. Generally positioned as an affordable ATS UAE option with transparent pricing models.

Greenhouse — Strong International Platform

Overall Score: 82/100

This brings powerful structured hiring methodology and robust talent acquisition software UAE capabilities, though with less UAE-specific optimization than purpose-built regional platforms.

Key Strengths:

- Excellent structured interview tools

- Strong recruitment CRM UAE functionality

- Sophisticated recruitment funnel analytics

- Extensive third-party integration ecosystem

Considerations:

- Limited native MOHRE compliant recruitment software features

- Multi-language ATS (Arabic support) requires additional configuration

- Premium pricing positioning less suitable for ATS for SMEs UAE

Best For: Multinational organizations with established structured hiring processes seeking to standardize globally.

Workable — User-Friendly Mid-Market Option

Overall Score: 79/100

This offers intuitive applicant tracking software UAE with rapid deployment and straightforward functionality, appealing particularly to growing organizations.

Key Strengths:

- Excellent ease of use and quick implementation

- Solid UAE job board integration coverage

- Mobile ATS UAE app with good functionality

- Transparent tiered pricing model

Considerations:

- Basic ATS with analytics UAE compared to enterprise platforms

- Limited AI recruitment software UAE sophistication

- Generic compliance features requiring manual UAE employment law compliance configuration

Best For: ATS for SMEs UAE and mid-market companies prioritizing simplicity and quick deployment over advanced features.

Comparison Table

Feature | Pitch N Hire | Greenhouse | Workable |

| UAE Market Fit | Excellent | Good | Good |

| MOHRE Compliance | Native | Manual | Manual |

| Arabic Support | Full | Limited | Limited |

| AI Capabilities | Advanced | Strong | Moderate |

| Emiratization Tracking | Built-in | Custom | Manual |

| Job Board Integration | Comprehensive | Moderate | Good |

| Ease of Use | Excellent | Good | Excellent |

| Analytics Depth | Advanced | Advanced | Moderate |

| Pricing Flexibility | High | Low | Moderate |

| Local Support | 24/7 UAE-based | International | International |

| Best For | All UAE organizations | Multinationals | SMEs |

Why Pitch N Hire Is Ideal for ATS Tracking in UAE

While several quality ATS tracking systems UAE options exist, we distinguishes itself through purpose-built capabilities addressing the specific challenges UAE employers face daily.

7.1 Expert Local Understanding

Our team wasn't adapted for the UAE market—it was built with UAE market needs as its foundation. This fundamental difference manifests throughout the platform.

Arabic and English Language Support: Unlike platforms treating Arabic as an add-on feature, we provides fully native multi-language ATS (Arabic support). Job postings, candidate communications, interview scheduling, and reporting all function seamlessly in both languages. The system intelligently detects candidate language preferences and adjusts communications accordingly, ensuring optimal candidate experience UAE.

Job Board Integrations Specific to UAE: The platform offers turnkey connectivity with every major UAE job board integration partner. Bayt ATS integration, GulfTalent integration, Naukrigulf ATS, and LinkedIn Middle East recruiting function as native features, not third-party plugins. Jobs post simultaneously across channels with a single action, while applications flow back into a unified candidate pipeline regardless of source.

Compliance with MOHRE Reporting and WPS Processes: our team provides the most comprehensive MOHRE compliant recruitment software capabilities available. The system automatically generates required government reports, tracks WPS compliance, manages visa processing tracking UAE documentation, and maintains audit trails demonstrating UAE employment law compliance. For organizations operating in free zones, specialized configurations support DIFC employment law ATS and ADGM compliance ATS requirements without custom development.

7.2 Advanced Features Designed for You

The AI-powered ATS UAE capabilities within we represent the cutting edge of recruitment technology UAE.

AI-Based Resume Parsing: The resume parsing software UAE engine accurately extracts information from CVs in multiple formats, including Arabic and English documents with varying layouts. Machine learning models trained on regional hiring patterns understand local education systems, job titles, and career progression norms that generic parsers often misinterpret.

Smart Candidate Matching: Predictive algorithms score candidates against role requirements, considering factors beyond simple keyword matching. The AI applicant tracking system learns from hiring decisions over time, continuously improving match accuracy and reducing false positives that waste recruiter time.

Analytics Dashboards Focused on Emiratization Metrics: Purpose-built reporting tracks Emiratization progress against government mandates. Dashboards visualize UAE national representation by department, seniority level, and business unit, with predictive analytics forecasting quota compliance trajectories. This ATS with analytics UAE specialization enables proactive workforce planning rather than reactive compliance scrambling.

Additional Advanced Features:

- Recruitment automation UAE workflows eliminating repetitive manual tasks

- Candidate relationship management UAE nurturing talent pools for future openings

- Interview scheduling software UAE with calendar integrations and automated reminders

- Mobile ATS UAE applications enabling recruitment on the go

- Customizable recruitment funnel analytics tracking conversion rates at each hiring stage

- Integration-ready APIs connecting to existing HRIS and payroll systems

7.3 Ease of Implementation

Technology sophistication means nothing if implementation becomes a prolonged, painful process. We poritizes deployment speed and simplicity.

Onboarding Assistance and Support: Dedicated implementation specialists guide organizations through every setup phase. Unlike platforms providing generic documentation and leaving customers to figure out configuration, We assigns UAE-based implementation consultants who understand regional hiring practices and can recommend optimal workflows based on industry-specific experience.

Seamless HRIS & Payroll Integrations: Pre-built connectors link with popular enterprise systems used throughout the Emirates. Whether integrating with SAP SuccessFactors, Oracle HCM, or regional payroll providers, the platform exchanges data securely and reliably. This hiring management software UAE integration capability eliminates the disconnected data silos that plague organizations using point solutions.

Tailored Setup for UAE Processes: Configuration templates reflect common UAE hiring workflows out of the box, dramatically reducing customization requirements. Settings for visa processing tracking UAE, WPS compliance tracking, and MOHRE compliant recruitment software reporting come pre-configured, enabling organizations to begin productive use within days rather than months.

The implementation timeline for typically spans 2-4 weeks for ATS for SMEs UAE and 4-8 weeks for enterprise ATS UAE deployments, including data migration, integration, training, and testing—significantly faster than comparable recruitment software UAE platforms.

7.4 Dedicated Customer Support

Ongoing support quality often differentiates satisfactory software from truly exceptional solutions. We has built a support infrastructure specifically for UAE customers.

24/7 Support with Localized Teams: UAE-based support staff understand local context, regulations, and business practices. Support operates in both Arabic and English, with response times averaging under 30 minutes for urgent issues. Unlike platforms routing all support through international call centers unfamiliar with UAE labor law compliant ATS requirements, Our support teams can troubleshoot region-specific scenarios confidently.

Training Resources for HR Managers: Comprehensive training programs ensure teams maximize platform value. Options include live training sessions, recorded webinars, detailed documentation, and scenario-based tutorials covering everything from basic candidate tracking system UAE operation to advanced recruitment funnel analytics interpretation. Specialized training modules address unique needs like Emiratization reporting or free zone compliance workflows.

Continuous Feature Updates Based on User Feedback: The platform evolves based on customer input rather than following an isolated product roadmap. Regular feature releases address emerging needs in the UAE hiring platform environment, from new regulatory requirements to integration with newly popular job boards. Customers receive advance notice of updates with clear migration guidance, ensuring changes enhance rather than disrupt operations.

7.5 Case Use Examples

Real-world our deployments demonstrate the tangible business impact organizations achieve.

High-Volume Hiring Processes: A UAE-based hospitality group conducting seasonal hiring of 500+ positions reduced their recruitment cycle from 45 days to 18 days using our platform. Automated resume screening software UAE qualified candidates within hours of application, while bulk interview scheduling and automated communication-maintained candidate engagement throughout the accelerated process. The recruitment automation UAE capabilities enabled a team of five recruiters to handle volume previously requiring twelve staff members.

Improved Recruiter Productivity Metrics: A Dubai technology firm measured recruiter effectiveness before and after implementation. The hiring software Dubai platform increased the number of qualified candidates each recruiter could manage simultaneously from 35 to 80, reduced time spent on administrative tasks by 60%, and improved interview scheduling efficiency by 75%. These productivity gains enabled the organization to absorb 40% headcount growth without expanding the recruitment team.

Shorter Time-to-Hire Across Industries: Organizations across retail, logistics, financial services, and manufacturing reported consistent time-to-hire reduction UAE averaging 32% in the first six months post-implementation. The combination of faster candidate sourcing through comprehensive UAE job board integration, intelligent screening via AI recruitment software UAE, and streamlined coordination through interview scheduling software UAE compressed every phase of the hiring lifecycle.

Customer Feedback & Testimonials

Direct feedback from organizations using validates the platform's effectiveness as the best ATS in UAE.

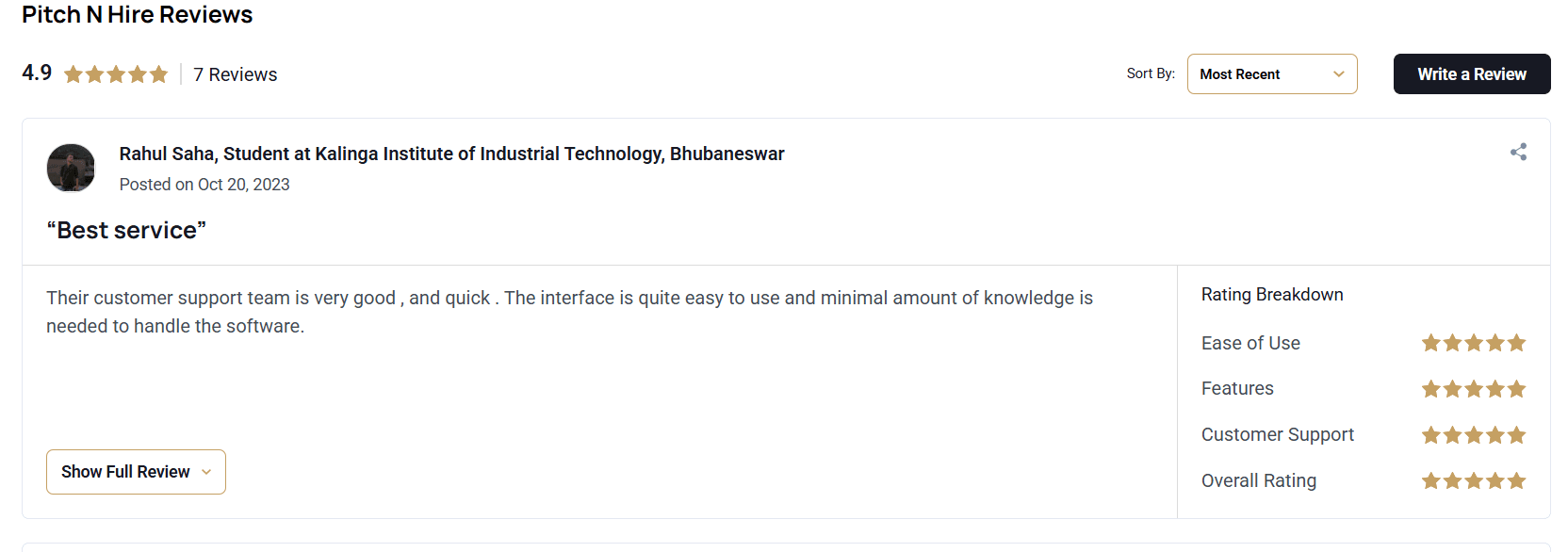

Platform: GoodFirms (software review directory)

Examples: Goodfirms

Rahul Saha – Student

“Best service… interface is easy to use.”

Source: https://www.goodfirms.co/software/pitch-n-hire Goodfirms

Amelia Grace – PrideStaff

“Software is simple to use… supportive team improving day by day.”

Source: https://www.goodfirms.co/software/pitch-n-hire Goodfirms

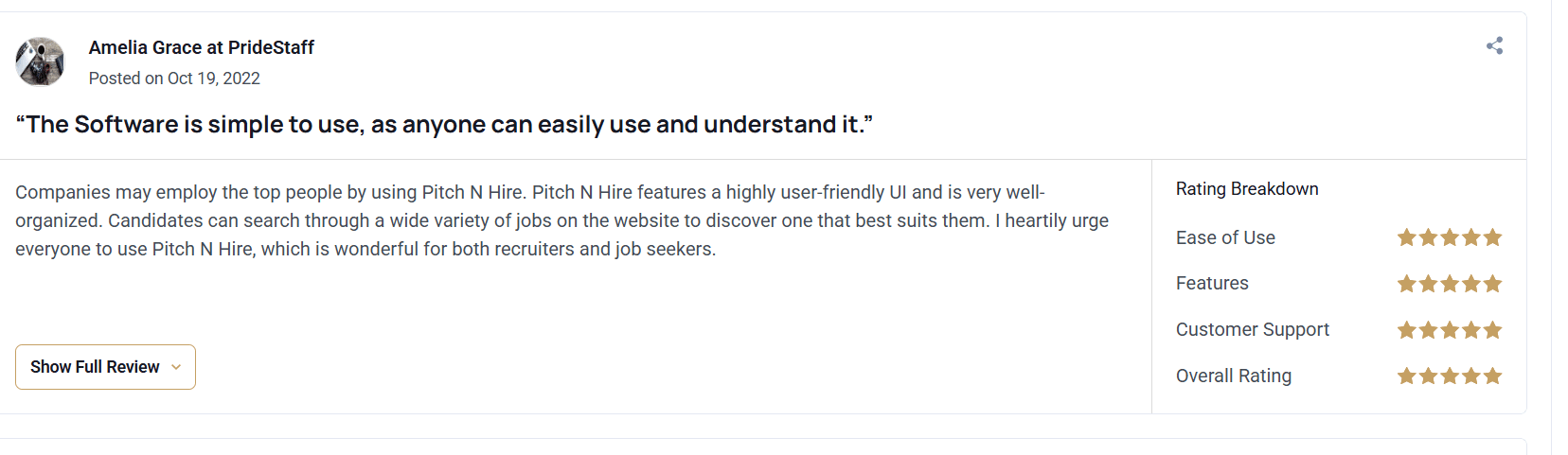

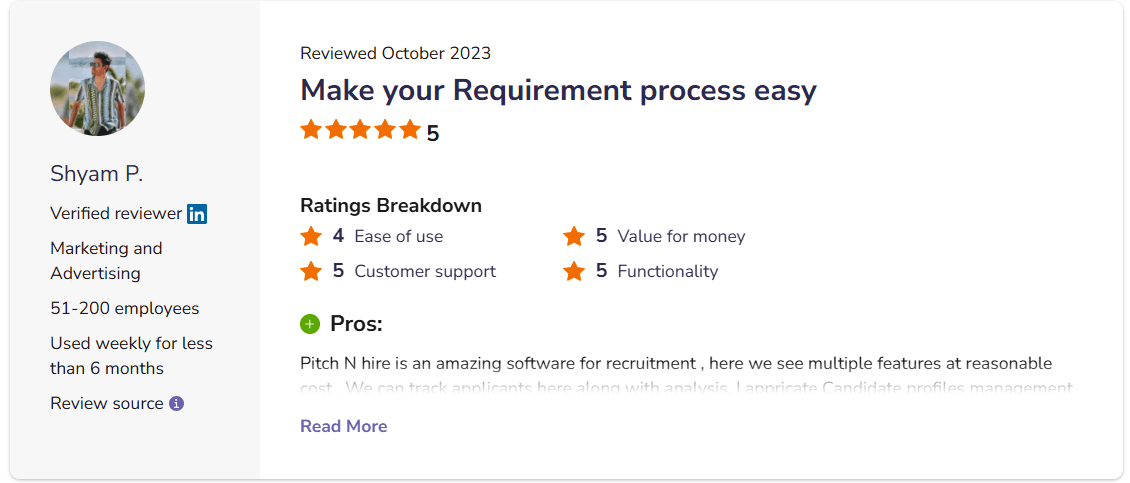

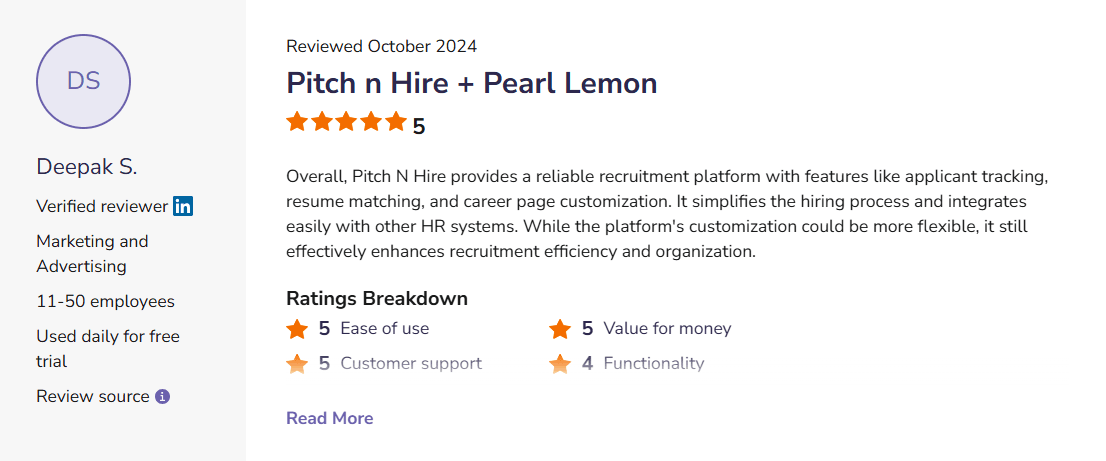

Platform: SoftwareAdvice (verified business reviews)

Overall Rating: 5.0/5 (multiple reviewers) Software Advice

Shyam P. – Marketing & Advertising (51–200 employees)

“Make your requirement process easy… track applicants along with analysis.”

Source: https://www.softwareadvice.com/recruitment-marketing-platform/pitch-n-hire-profile/ Software Advice

Deepak S. – Marketing & Advertising (11–50 employees)

“Reliable recruitment platform… helps hire and organize faster.”

Source: https://www.softwareadvice.com/recruitment-marketing-platform/pitch-n-hire-profile/ Software Advice

Reviewer (VR) – Computer Software (1001–5000 employees)

“Makes recruitment handy… unique platform.”

Source: https://www.softwareadvice.com/recruitment-marketing-platform/pitch-n-hire-profile/ Software Advice

Why These Reviews Matter

These testimonials provide critical trust signals for organizations evaluating applicant tracking system UAE options:

Credibility Through Real-World Performance: The specific metrics cited—30% time-to-hire reduction, 40% cost savings—demonstrate tangible business impact, not vague improvement claims. These outcomes reflect what properly implemented recruitment software UAE can achieve.

Reinforcement of Value Propositions: Customer feedback validates the platform strengths discussed throughout this article. Compliance ease, multilingual capability, integration quality, and support responsiveness appear as recurring themes because they represent genuine differentiators, not marketing hyperbole.

Increased User Confidence for Decision-Making: Prospective customers recognize that organizations similar to their own—Dubai tech firms, Abu Dhabi retailers, Sharjah logistics companies—have successfully implemented Pitch N Hire and achieved measurable results. This peer validation reduces perceived implementation risk and accelerates purchasing decisions.

Our Methodology for ATS Evaluation

Selecting the best ATS in UAE requires systematic evaluation against criteria reflecting both universal recruitment needs and region-specific requirements. Our assessment framework examines six critical dimensions.

Evaluation Criteria

1. Effectiveness of Recruitment

We measure how well each applicant tracking software UAE platform improves hiring outcomes through metrics like quality-of-hire scores, interview-to-offer ratios, and new hire retention rates. The most effective systems demonstrate measurable improvements in these business results, not just process efficiency.

2. AI & Automation Capabilities

Modern AI applicant tracking system features distinguish leading platforms from legacy software. We assess:

- Resume parsing software UAE accuracy across diverse formats

- Predictive candidate scoring algorithms

- Automated workflow triggers and notifications

- Recruitment automation UAE reducing manual tasks

- Natural language processing for search and matching

3. UAE Market Fit

Critical for the region, we evaluate multi-language ATS (Arabic support) quality, MOHRE compliant recruitment software functionality, UAE job board integration breadth, and specialized features supporting Emiratization tracking. Solutions lacking robust localization score significantly lower regardless of other strengths.

4. Ease of Use

The best technology becomes useless if adoption suffers due to complexity. We test user interfaces from recruiter, hiring manager, and candidate perspectives, evaluating learning curves, navigation intuitiveness, and mobile ATS UAE functionality. Systems requiring extensive training or producing user frustration receive reduced scores.

5. Analytics & Reporting

Data-driven recruitment demands comprehensive ATS with analytics UAE capabilities. We examine pre-built reports, custom dashboard creation, recruitment funnel analytics depth, Emiratization compliance reporting, and export flexibility. Leading platforms provide actionable insights, not just data dumps.

6. ROI & Pricing

We consider ATS software pricing UAE structures, implementation costs, ongoing support expenses, and user licensing models. Value assessment balances features against total cost of ownership for different organization sizes, from ATS for startups UAE to enterprise ATS UAE deployments. The evaluation includes affordable ATS UAE options suitable for budget-conscious SMEs.

Scoring Logic

Each criterion receives a weighted score reflecting its importance to UAE hiring success:

- UAE Market Fit: 25% (most critical differentiator)

- Effectiveness of Recruitment: 20%

- AI & Automation: 20%

- Analytics & Reporting: 15%

- Ease of Use: 12%

- ROI & Pricing: 8%

This methodology prioritizes solutions purpose-built for the UAE hiring platform environment while ensuring they deliver tangible business value.

The UAE Hiring Landscape in 2026

The United Arab Emirates presents a unique recruitment environment that demands specialized hiring software Dubai and recruitment software Sharjah solutions. Several factors distinguish the Middle East recruitment software market from global counterparts.

Unique Regional Challenges

Compliance Complexity: UAE organizations must navigate intricate regulatory frameworks including MOHRE compliant recruitment software requirements, WPS compliance tracking, visa processing tracking UAE, and specialized regulations within free zones like DIFC employment law ATS and ADGM compliance ATS standards. Traditional applicant tracking system UAE platforms often lack the localization necessary to handle these requirements seamlessly.

Multilingual Hiring Needs: The UAE's diverse workforce requires multi-language ATS (Arabic support) as standard functionality, not an afterthought. Recruitment communications, job postings, and candidate interfaces must operate fluidly in both Arabic and English to serve the local and expatriate populations effectively.

Emiratization Mandates: Government initiatives promoting UAE national employment create additional tracking and reporting requirements. Organizations need ATS with analytics UAE specifically designed to monitor Emiratization targets, quota compliance, and workforce nationalization metrics.

High-Volume Recruitment: Industries like hospitality, retail, and construction frequently conduct mass hiring campaigns. ATS for startups UAE and enterprise ATS UAE must both handle these scenarios while maintaining quality standards.

Growth of Tech-Enabled HR Solutions

The UAE has emerged as a regional leader in HR technology adoption. Investment in AI-powered ATS UAE platforms has accelerated as organizations recognize that manual recruitment processes cannot scale with the nation's economic growth trajectory. The best applicant tracking system UAE 2026 offerings reflect this maturation, incorporating machine learning, predictive analytics, and seamless integration capabilities that were unavailable even two years ago.

Government digital initiatives have created infrastructure supporting cloud based ATS UAE deployment, while increasing comfort with remote work has expanded the talent pool beyond physical borders, making sophisticated candidate tracking system UAE capabilities essential.

Why an ATS System Is a Must in UAE

The business case for implementing recruitment software UAE has never been stronger. Organizations delaying ATS adoption face mounting competitive disadvantages across several dimensions.

Faster Time-to-Hire

In markets where top talent receives multiple offers within days, speed determines success. Hiring management software UAE reduces recruitment cycle times through:

- Instant job distribution across UAE job board integration partners

- Automated resume screening software UAE that qualifies candidates in minutes

- Intelligent interview scheduling software UAE that eliminates coordination delays

- Mobile ATS UAE access enabling recruiters to review candidates anywhere, anytime

Organizations using top ATS systems UAE report average time-to-hire reductions of 35-40%, directly impacting their ability to secure preferred candidates before competitors.

Better Candidate Experience

Today's job seekers expect consumer-grade digital experiences. Clunky application processes with poor communication lead candidates to abandon applications or accept competing offers. A modern talent acquisition software UAE platform provides:

- Mobile-optimized application interfaces

- Real-time status updates

- Personalized communication touchpoints

- Transparent timeline expectations

Positive candidate experiences strengthen employer branding and increase acceptance rates, particularly critical when competing for specialized technical talent.

Data Compliance

The stakes for compliance failures have increased substantially. UAE employment law compliance violations can result in significant penalties, operational restrictions, or reputational damage. A robust UAE labor law compliant ATS provides:

- Automated MOHRE compliant recruitment software reporting

- WPS compliance tracking with payroll system integration

- Visa processing tracking UAE with document management

- Audit trails demonstrating regulatory adherence

- Configurable workflows matching DIFC employment law ATS or ADGM compliance ATS requirements for free zone entities

Integration with UAE Job Boards and MOHRE

Standalone recruitment processes create inefficiency through manual data entry and disconnected systems. Leading ATS platforms Dubai offer native integrations with:

- Bayt ATS integration for the region's largest job portal

- GulfTalent integration for professional and management positions

- Naukrigulf ATS connectivity for diverse industry sectors

- LinkedIn Middle East recruiting for passive candidate sourcing

- Direct MOHRE compliant recruitment software interfaces for government reporting

These integrations eliminate duplicate work while ensuring consistent data across systems.

Implementation Best Practices in UAE

Successful ATS tracking systems UAE deployment requires more than selecting quality software. Following proven implementation practices maximizes value realization and user adoption.

Step-by-Step Setup Checklist

Phase 1: Planning (Week 1)

- Define clear success metrics aligned with business objectives

- Map existing hiring workflows and identify process improvement opportunities

- Determine UAE job board integration requirements and account setups

- Identify key stakeholders and establish project governance

- Audit existing candidate data for potential migration

Phase 2: Configuration (Weeks 2-3)

- Configure job templates and application forms with multi-language ATS (Arabic support)

- Set up user roles, permissions, and approval workflows

- Establish MOHRE compliant recruitment software reporting parameters

- Configure WPS compliance tracking and visa processing tracking UAE workflows

- Customize recruitment funnel analytics dashboards

- Integrate Bayt ATS integration, GulfTalent integration, and Naukrigulf ATS connections

Phase 3: Integration (Week 3-4)

- Connect hiring management software UAE with existing HRIS systems

- Configure payroll system data exchange for WPS compliance

- Set up email system integration for candidate communication

- Enable calendar integrations for interview scheduling software UAE

- Test data flows between systems

Phase 4: Testing (Week 4-5)

- Conduct end-to-end workflow testing with sample requisitions

- Verify resume parsing software UAE accuracy across document types

- Test mobile ATS UAE functionality on various devices

- Validate UAE employment law compliance reporting accuracy

- Perform user acceptance testing with recruiter and hiring manager representatives

Phase 5: Training & Launch (Week 5-6)

- Conduct role-specific training for recruiters, hiring managers, and administrators

- Provide documentation and quick reference guides

- Execute soft launch with select departments before organization-wide rollout

- Establish support processes and escalation paths

Common Integrations

Successful applicant tracking software UAE implementations typically include:

- Job Boards: LinkedIn Middle East recruiting, Bayt, GulfTalent, Naukrigulf

- HRIS Systems: SAP SuccessFactors, Oracle HCM, Workday, regional platforms

- Background Check Providers: UAE-specific verification services

- Assessment Tools: Skills testing and cognitive assessment platforms

- Video Interview Platforms: HireVue, Spark Hire for remote candidate screening

- Payroll Systems: For WPS compliance tracking data exchange

- Email & Calendar: Outlook, Google Workspace for communication and scheduling

Tips to Reduce Resistance to Change

Technology adoption challenges often exceed technical implementation difficulties. Minimize resistance through:

Early Stakeholder Involvement: Include hiring managers and recruiters in vendor selection and configuration decisions. People support what they help create.

Clear Communication of Benefits: Articulate how the AI-powered ATS UAE reduces their personal workload, not just organizational costs. Frame the change as empowerment, not surveillance.

Gradual Rollout: Implement department by department rather than organization-wide simultaneously. Early successes build momentum and provide internal advocates.

Quick Wins: Configure the system to deliver immediately visible benefits like automated interview scheduling or simplified candidate communication. Early positive experiences increase overall acceptance.

Ongoing Support: Expect questions and difficulties during the first month. Accessible support and patience during the adjustment period prevent abandonment and workarounds.

Analytics Optimization

Maximize value from ATS with analytics UAE capabilities:

Start with Core Metrics: Focus initially on fundamental measures like time-to-hire, source effectiveness, and cost-per-hire UAE. Add sophisticated analytics after establishing baseline reporting discipline.

Establish Regular Review Cadence: Schedule weekly or biweekly sessions reviewing recruitment funnel analytics. Consistent attention to data drives continuous improvement.

Link Metrics to Actions: Every metric should inform specific decisions. If a dashboard doesn't drive action, eliminate it to reduce noise.

Customize for Stakeholder Audiences: Executives need high-level recruitment efficiency UAE summaries; recruiters need detailed source performance data. Tailor dashboards to user needs.

Track Emiratization Progress: Configure specialized reporting monitoring UAE national hiring against quotas, enabling proactive compliance management rather than reactive crisis response.

Future Trends in ATS (2026 & Beyond)

The recruitment technology UAE landscape continues evolving rapidly. Organizations selecting top ATS systems UAE should consider emerging capabilities shaping the next generation of platforms.

AI Hiring Assistant Bots

Conversational AI is transforming candidate interaction. Advanced AI applicant tracking system platforms now deploy chatbots that conduct initial candidate screening through natural language conversations in both Arabic and English. These assistants answer candidate questions 24/7, collect basic information, and even conduct preliminary skills assessments before human recruiter involvement.

The next evolution involves AI assistants supporting recruiters directly—drafting job descriptions, suggesting interview questions based on role requirements, and providing real-time coaching during candidate evaluations. These capabilities augment rather than replace human judgment, making recruiters more effective Manufacturing Applicant Tracking System: Top 10 Recruitment Software.

Predictive Talent Insights

Machine learning models analyzing historical hiring data now predict which candidates will succeed in specific roles with remarkable accuracy. The best applicant tracking system UAE 2026 platforms incorporate predictive scoring that considers factors beyond resume matching, including cultural fit indicators, learning agility signals, and retention risk factors.

Forward-looking organizations use these insights proactively, identifying internal candidates for advancement before external recruiting becomes necessary. Predictive analytics also forecast hiring needs based on business growth patterns, enabling proactive rather than reactive talent acquisition software UAE utilization.

Cross-Platform Automation

The future of hiring software UAE involves seamless data flow across the entire HR technology ecosystem. Next-generation applicant tracking software UAE will automatically update learning management systems once candidates become employees, trigger onboarding workflows in collaboration platforms, and sync compensation data with payroll systems—all without manual intervention.

API-first architectures enable unlimited integration possibilities, allowing organizations to construct customized technology stacks connecting best-of-breed solutions for recruiting, onboarding, performance management, learning, and succession planning. The ATS platforms Dubai leading this evolution prioritize integration flexibility over attempting to become all-in-one suites that excel at nothing.

Enhanced Compliance Automation

Regulatory requirements continue increasing in complexity. Future UAE labor law compliant ATS platforms will incorporate regulatory monitoring that automatically adjusts compliance workflows when laws change. Rather than requiring manual configuration updates whenever UAE employment law compliance rules evolve, intelligent systems will self-update based on official government announcements.

Blockchain integration may eventually provide tamper-proof audit trails for MOHRE compliant recruitment software processes, offering regulators transparent visibility while protecting candidate privacy. Smart contracts could automate aspects of visa processing tracking UAE, reducing manual coordination between employers, government agencies, and candidates.

Hyper-Personalization

Candidate expectations for personalized experiences continue rising. Future recruitment CRM UAE capabilities will deliver individualized candidate journeys based on role seniority, industry background, and communication preferences. AI will optimize message timing, channel selection, and content tone for maximum engagement with each candidate segment.

These personalization engines will also customize the application and interview experience, adjusting difficulty and format based on role requirements while maintaining fairness and compliance standards. The goal is making every candidate feel the opportunity was designed specifically for them, dramatically improving candidate experience UAE and acceptance rates.

Frequently Asked Questions

What is an ATS?

An ATS (Applicant Tracking System) is software that manages the recruitment process from job posting through candidate hiring. Modern ATS software UAE platforms automate candidate sourcing, application management, resume screening, interview scheduling, and compliance tracking. They serve as the central operating system for talent acquisition software UAE activities, improving efficiency while ensuring consistent, compliant hiring practices.

How does ATS help with Emiratization?

Specialized ATS tracking systems UAE support Emiratization through dedicated analytics tracking UAE national representation across departments and seniority levels. The platforms monitor progress against government quotas, highlight underrepresented areas, and forecast compliance trajectories. They also enable targeted sourcing campaigns focused on Emirati candidates through UAE job board integration with platforms emphasizing national talent. Automated reporting generates government-required documentation, while custom workflows can prioritize UAE national applications for faster review, helping organizations meet their nationalization objectives systematically.

Is Our Platform suitable for small businesses?

Absolutely. We offers flexible pricing and configuration options making it an excellent ATS for startups UAE and ATS for SMEs UAE. Small organizations benefit from the same MOHRE compliant recruitment software capabilities and AI recruitment software UAE features available to enterprises, but with pricing scaled appropriately to company size. The platform's ease of implementation and intuitive interface mean small teams can begin productive use quickly without extensive IT resources. Many small businesses find more affordable ATS UAE than attempting to manage hiring through spreadsheets and email, once they account for the hours saved through recruitment automation UAE.

How long does implementation take?

Implementation timelines vary based on organization size and complexity. Typical deployments require:

- Small Organizations (under 100 employees): 2-3 weeks including configuration, basic integrations, training, and testing

- Mid-Market Companies (100-500 employees): 3-5 weeks including HRIS integration, workflow customization, department-specific configuration, and comprehensive training

- Enterprise Organizations (500+ employees): 6-8 weeks including complex integrations, multi-entity configuration, advanced recruitment funnel analytics setup, and staged rollout across divisions

These timelines assume reasonable customer responsiveness and decision-making. Organizations prioritizing rapid deployment can often accelerate further, while those with extensive customization requirements may extend implementation periods. Our dedicated implementation support throughout the process ensures projects stay on track regardless of timeline.

What makes Pitch N Hire different from international ATS platforms?

Our Platfom differs fundamentally by being purpose-built for the UAE market rather than adapted to it. Key distinctions include native MOHRE compliant recruitment software capabilities versus manual configuration requirements, comprehensive multi-language ATS (Arabic support) throughout the platform versus limited translation, turnkey UAE job board integration including Bayt ATS integration and GulfTalent integration, Emiratization-specific analytics, and 24/7 UAE-based support teams understanding local regulations. International platforms often require expensive customization to achieve similar functionality, and even then typically lack the deep UAE employment law compliance understanding embedded in team.

Can the system integrate with our existing HR software?

Yes. Pitch N Hire provides extensive integration capabilities with popular HRIS, payroll, and enterprise systems used throughout the UAE. Pre-built connectors support major platforms like SAP SuccessFactors, Oracle HCM, and regional providers, while flexible APIs enable custom integration with proprietary systems. The hiring management software UAE platform exchanges candidate, employee, and compliance data seamlessly, eliminating duplicate data entry while ensuring WPS compliance tracking across systems. During implementation, technical teams assess your existing technology stack and recommend optimal integration architecture.

How does the AI resume parsing handle Arabic CVs?

Resume parsing software UAE uses machine learning models specifically trained on Arabic and English CVs from the Middle East region. Unlike generic parsers that struggle with Arabic text or regional formatting conventions, the system

accurately extracts education, experience, skills, and contact information from Arabic documents. The AI applicant tracking system understands regional education systems, local company names, and bilingual CV formats common in the UAE market. Parsing accuracy for Arabic CVs matches or exceeds the platform's performance with English documents, ensuring fair and effective screening regardless of candidate language preferences.

What security measures protect candidate data?

We implements enterprise-grade security protecting sensitive recruitment data. Measures include data encryption in transit and at rest, role-based access controls ensuring users only access appropriate information, regular security audits and penetration testing, compliance with international data protection standards, secure hosting infrastructure with redundancy and disaster recovery capabilities, and automated backup processes. The platform's UAE labor law compliant ATS design also addresses specific regional data residency requirements, with options for UAE-based data hosting when required by organizational policies or regulations.

Can we customize workflows for different departments?

Completely. Pitch N Hire provides extensive workflow customization capabilities enabling different approval chains, interview processes, and screening criteria for various departments, job families, or seniority levels. Organizations can configure unique hiring workflows for technical positions versus sales roles, executive searches versus entry-level recruitment, or any other distinction relevant to their needs. The recruitment software UAE flexibility ensures the system adapts to your processes rather than forcing process changes to fit software limitations. Customization doesn't require programming knowledge—administrators configure workflows through intuitive visual interfaces during setup or anytime thereafter.

What training and support come with the platform?

We includes comprehensive training and ongoing support as standard. Initial implementation includes role-specific training for recruiters, hiring managers, and system administrators, covering everything from basic candidate tracking system UAE operation through advanced recruitment funnel analytics interpretation. Training formats include live sessions, recorded webinars, detailed documentation, and hands-on exercises. Post-implementation, 24/7 support operates with UAE-based teams providing assistance in Arabic and English. Access to a knowledge base, regular platform updates webinars, and dedicated customer success managers ensure you continuously maximize your AI-powered ATS UAE investment. Most customer questions receive responses within 30 minutes, with urgent issues addressed immediately.

Conclusion

The evolution of ATS tracking systems UAE has fundamentally transformed how organizations approach talent acquisition in the Emirates. As we've explored throughout this comprehensive guide, modern applicant tracking software UAE delivers far beyond simple resume collection—these platforms now serve as strategic business systems driving competitive advantage through faster hiring, better candidate experiences, complete compliance assurance, and data-driven decision making.

The UAE hiring landscape presents unique complexities that generic recruitment software UAE often fails to address adequately. From MOHRE compliant recruitment software requirements and WPS compliance tracking to multi-language ATS (Arabic support) and Emiratization reporting, organizations need solutions purpose-built for the region's specific environment.

Our team has established itself as the best ATS in UAE through unwavering focus on these local requirements combined with cutting-edge AI recruitment software UAE capabilities. The platform's comprehensive UAE job board integration, including seamless Bayt ATS integration, GulfTalent integration, and Naukrigulf ATS connectivity, ensures maximum candidate reach. Its native compliance features eliminate the manual work and risk associated with UAE employment law compliance. And its sophisticated recruitment funnel analytics provide the visibility needed to continuously optimize recruitment efficiency UAE.

Whether you're managing ATS for startups UAE with lean teams and limited budgets or overseeing enterprise ATS UAE deployments across multiple emirates and business units, we deliver the hiring software Dubai, ATS Abu Dhabi, and recruitment software Sharjah organizations need to compete effectively for talent.

The platform's proven track record—reflected in consistent time-to-hire reduction UAE averaging 30-40%, dramatic improvements in recruiter productivity, and enthusiastic customer testimonials—demonstrates its real-world business impact. Organizations implementing, we don't just adopt new software; they fundamentally transform their approach to talent acquisition software UAE, positioning themselves as employers of choice in one of the world's most competitive hiring markets.

Take the Next Step

The competitive advantages delivered by modern ATS software UAE grow more pronounced with each passing quarter. Organizations still relying on manual recruitment processes, disconnected systems, or legacy platforms lacking regional optimization fall further behind competitors leveraging sophisticated AI-powered ATS UAE capabilities.

Ready to transform your hiring process?

- Request a personalized demo to see how addresses your specific hiring challenges

- Start a free trial to experience the platform's intuitive interface and powerful features firsthand

- Speak with a UAE-based specialist to discuss your requirements and explore how we can support your talent acquisition goals

- Download our implementation guide for detailed planning resources preparing your organization for successful ATS deployment

As the best applicant tracking system UAE 2026, Our Platform is trusted by organizations across the Emirates to handle their most important asset—their people. Join the growing number of UAE employers who have discovered that the right recruitment technology UAE doesn't just make hiring easier; it makes their organizations stronger, more competitive, and better positioned for sustained success.

Contact Pitch N Hire today and discover why leading UAE organizations choose us as their hiring management software UAE partner. Your next great hire is waiting—let's help you find them faster, smarter, and more efficiently than ever before.

Contact: info@pitchnhire.com | https://pitchnhire.com/contact-us

Applicant Tracking System for Recruiters

Best Applicant Tracking System 2026 | Top ATS Software Compared

Best Applicant Tracking System 2026 USA | Top ATS Software

Best Applicant Tracking System 2026 UK | Top ATS Platforms

Best Applicant Tracking System 2026 Canada| Top ATS Software

Best Applicant Tracking System India 2026

Best Applicant Tracking System Online 2026 | Top 10 ATS

ATS Recruitment Software Comparison | Best ATS Comparison

Best ATS for Small Business Software

Best Applicant Tracking System 2026 Australia | Top ATS Software

ATS for High Volume Hiring 2026

cloud based recruitment software

ATS Tracking Systems UAE 2026 Applicant Tracking Software

applicant tracking system for small business

best applicant tracking system for small business

healthcare recruitment software

staff scheduling software healthcare

Top 10 ATS for Logistics Companies | Best Applicant Tracking Systems for Hiring

Hospitality Applicant Tracking System | Top 10 Restaurant Hiring Software

healthcare employee scheduling software